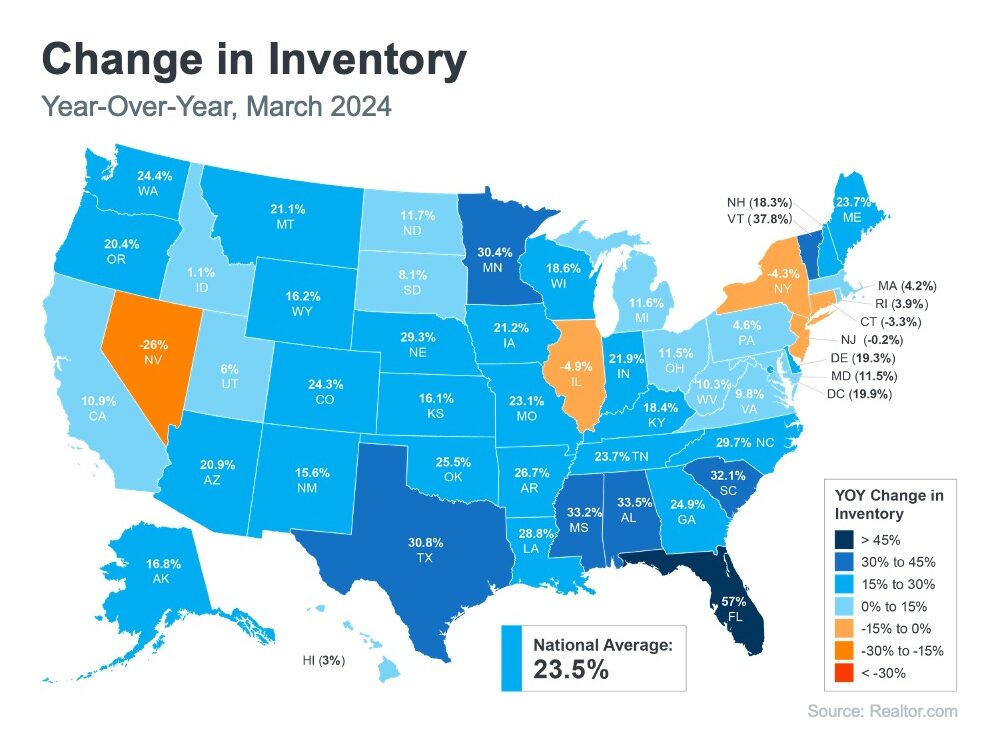

The inventory of homes actively for sale increased in 45 out of 50 of the largest metros compared with last year, and in four large metros, inventory was above pre-pandemic levels. With the anticipation of lower mortgage rates by the end of the year, home buyers could have more options and a bit more affordability.

The inventory of homes actively for sale increased in 45 out of 50 of the largest metros compared with last year, and in four large metros, inventory was above pre-pandemic levels. With the anticipation of lower mortgage rates by the end of the year, home buyers could have more options and a bit more affordability.

Insights

“Current expectations are that the Fed will start to cut rates at some point between June and September. The exact timing depends on how incoming economic data looks. The Fed’s March meeting did not set up the prospect of a near-term interest rate cut, but a summer cut appears likely.

Forbes

“Consumer attitudes toward home-selling conditions increased markedly in February, with current homeowners, in particular, expressing greater optimism that it’s a ‘good time to sell,’ a development that may foreshadow an upcoming increase in existing home listings.

Doug Duncan, Senior VP and Chief Economist, Fannie Mae

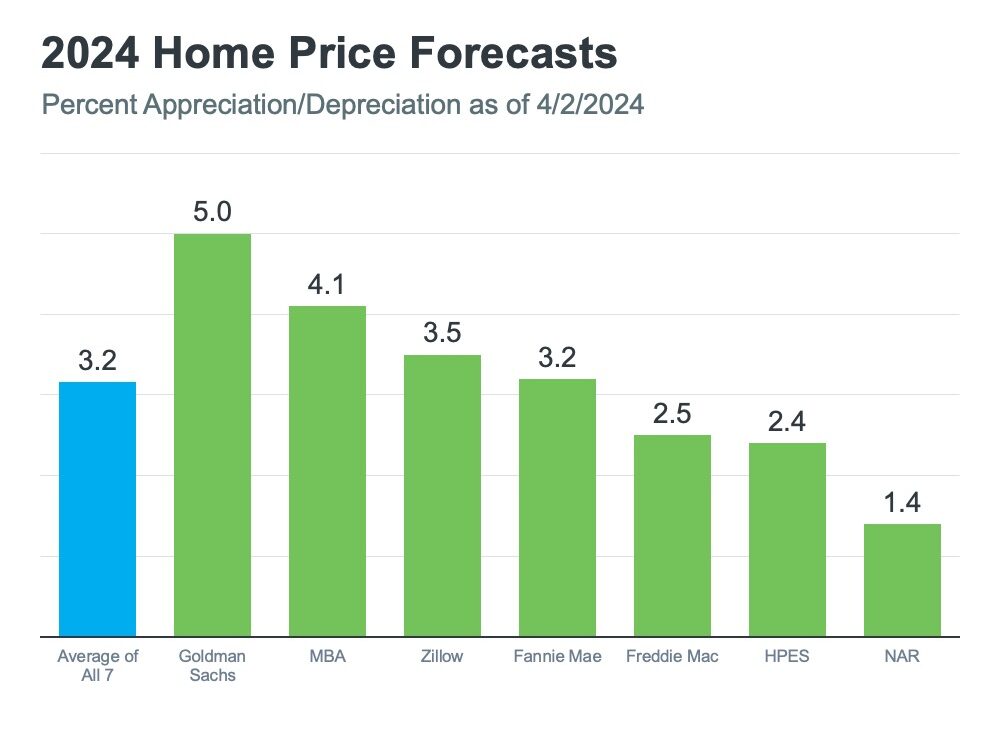

Forecasts

Housing prices in the US were surprisingly resilient last year in the face of a jump in mortgage rates. Now, with the prospect of interest rate cuts on the horizon, home prices are expected to climb more than previously anticipated, according to Goldman Sachs Research. In 2025, prices are expected to rise 3.7%, compared with the earlier forecast of 2.8%. Thirty-year fixed mortgages rates, meanwhile, are expected to fall to 6.3% by the end of this year, making homes slightly more affordable. – Goldman Sachs

Rates

Recent inflation news suggests that rates are likely to hold fairly steady in the coming months with “higher for longer” as the key refrain being repeated by the industry. That said, the economists at Fannie Mae, MBA and NAR all expect mortgage interest rates to decrease in the third and fourth quarter of 2024.

Recent inflation news suggests that rates are likely to hold fairly steady in the coming months with “higher for longer” as the key refrain being repeated by the industry. That said, the economists at Fannie Mae, MBA and NAR all expect mortgage interest rates to decrease in the third and fourth quarter of 2024.

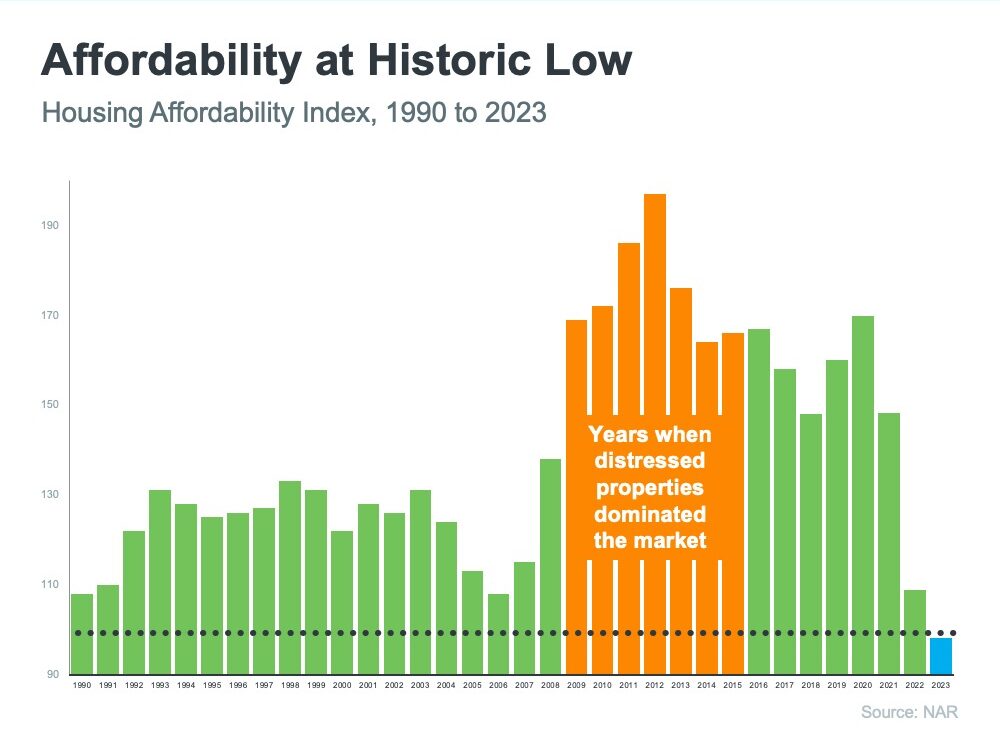

Affordability

When you zoom out, affordability is still very, very low from a historical perspective, said Odeta Kushi, Deputy Chief Economist, First American. And in a recent article, Zillow shared that “while affordability will undoubtedly remain the top concern for potential home buyers in 2024, there is reason to expect those challenges to ease just a bit.”

When you zoom out, affordability is still very, very low from a historical perspective, said Odeta Kushi, Deputy Chief Economist, First American. And in a recent article, Zillow shared that “while affordability will undoubtedly remain the top concern for potential home buyers in 2024, there is reason to expect those challenges to ease just a bit.”

Inventory

For the first three months of this year, the inventory of homes actively for sale was at its highest level since 2020. However, while inventory this March is much improved compared with the previous three years, it is still down 37.9% compared with typical 2017 to 2019 levels. In March, as in the previous month, the growth in homes particularly priced in the $200,000 to $350,000 range outpaced all other price categories, as home inventory in this range grew by 30.5% compared with last year. – Realtor.com.

For the first three months of this year, the inventory of homes actively for sale was at its highest level since 2020. However, while inventory this March is much improved compared with the previous three years, it is still down 37.9% compared with typical 2017 to 2019 levels. In March, as in the previous month, the growth in homes particularly priced in the $200,000 to $350,000 range outpaced all other price categories, as home inventory in this range grew by 30.5% compared with last year. – Realtor.com.

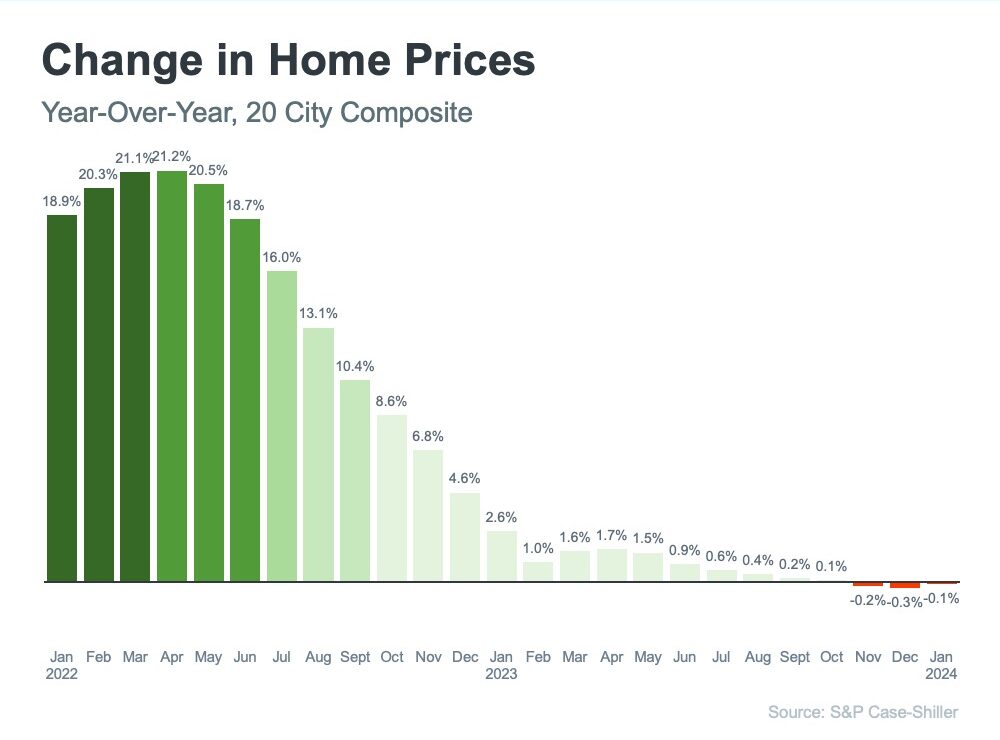

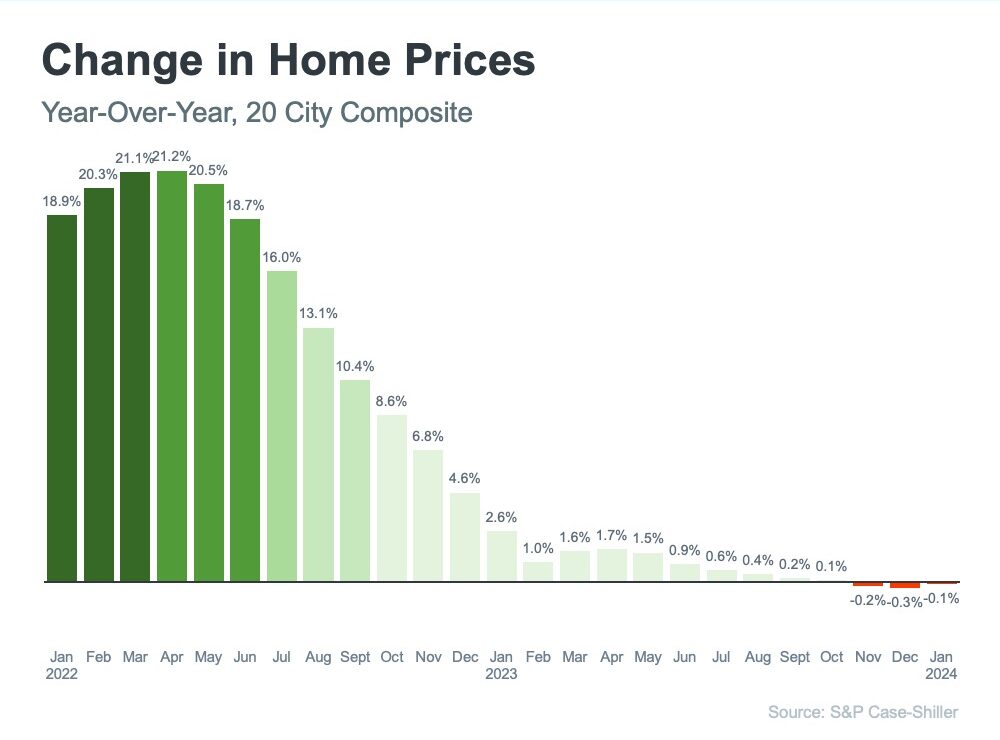

Prices

March 2024 brought 4.19 million in sales, a median sales price of $393,500, and 3.2 months of inventory. And according to Zillow’s latest forecast, home values are expected to hold steady in 2024, falling just 0.2%.

March 2024 brought 4.19 million in sales, a median sales price of $393,500, and 3.2 months of inventory. And according to Zillow’s latest forecast, home values are expected to hold steady in 2024, falling just 0.2%.

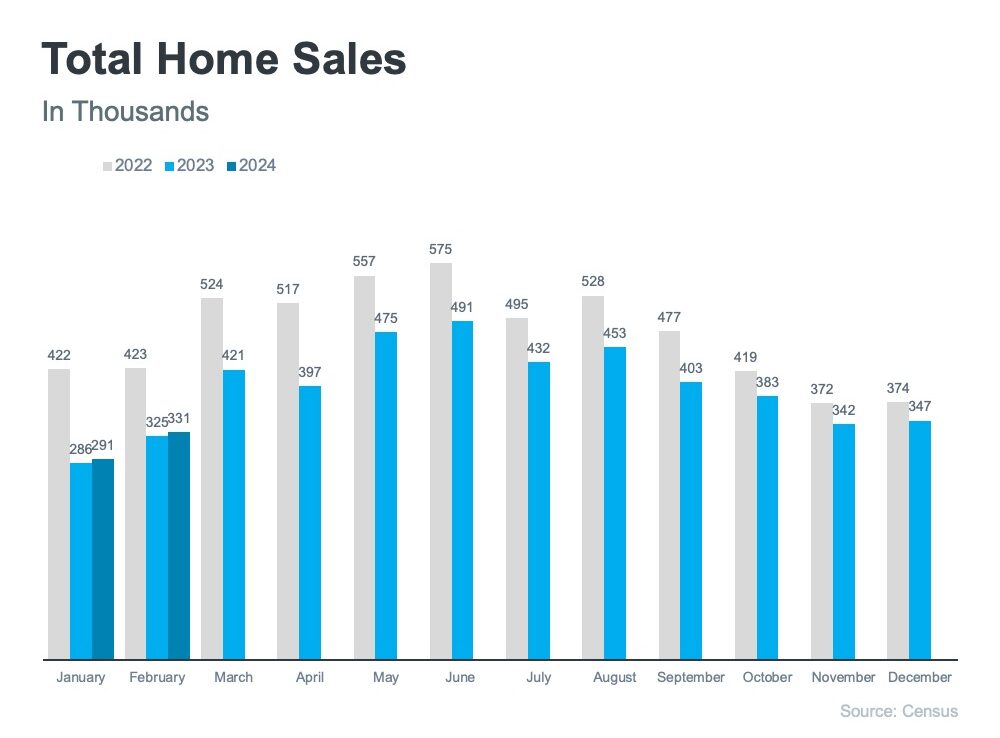

Sales

March 2024 brought 4.19 million in sales, a median sales price of $393,500, and 3.2 months of inventory. The median sales price is up 4.8% year-over-year, and inventory was up 0.5 months from March 2023. According to Realtor.om, sellers turned out in higher numbers this March as newly listed homes were 15.5% above last year’s levels, marketing the fifth month of increasing listing activity after a 17-month streak of decline.

March 2024 brought 4.19 million in sales, a median sales price of $393,500, and 3.2 months of inventory. The median sales price is up 4.8% year-over-year, and inventory was up 0.5 months from March 2023. According to Realtor.om, sellers turned out in higher numbers this March as newly listed homes were 15.5% above last year’s levels, marketing the fifth month of increasing listing activity after a 17-month streak of decline.

More Charts…

Do you love housing data? Whether you are a real estate expert or just learning about the market, this is the housing data to know. Enjoy 50+ charts illustrating the key metrics for the month.

Do you love housing data? Whether you are a real estate expert or just learning about the market, this is the housing data to know. Enjoy 50+ charts illustrating the key metrics for the month.